You are here:Chùa Bình Long – Phan Thiết > bitcoin

Bitcoin Price Fraud: Unveiling the Dark Side of Cryptocurrency Markets

Chùa Bình Long – Phan Thiết2024-09-22 01:29:09【bitcoin】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, Bitcoin has gained immense popularity as a digital currency, attracting both invest airdrop,dex,cex,markets,trade value chart,buy,In recent years, Bitcoin has gained immense popularity as a digital currency, attracting both invest

In recent years, Bitcoin has gained immense popularity as a digital currency, attracting both investors and enthusiasts worldwide. However, alongside its rise, the issue of Bitcoin price fraud has become increasingly prevalent, casting a shadow over the credibility of the cryptocurrency market. This article aims to shed light on the dark side of Bitcoin price fraud, exploring its various forms and implications.

Bitcoin price fraud refers to any deceptive practice employed to manipulate the value of Bitcoin, either for personal gain or to undermine the credibility of the market. There are several methods through which Bitcoin price fraud can occur, making it a complex and challenging issue to tackle.

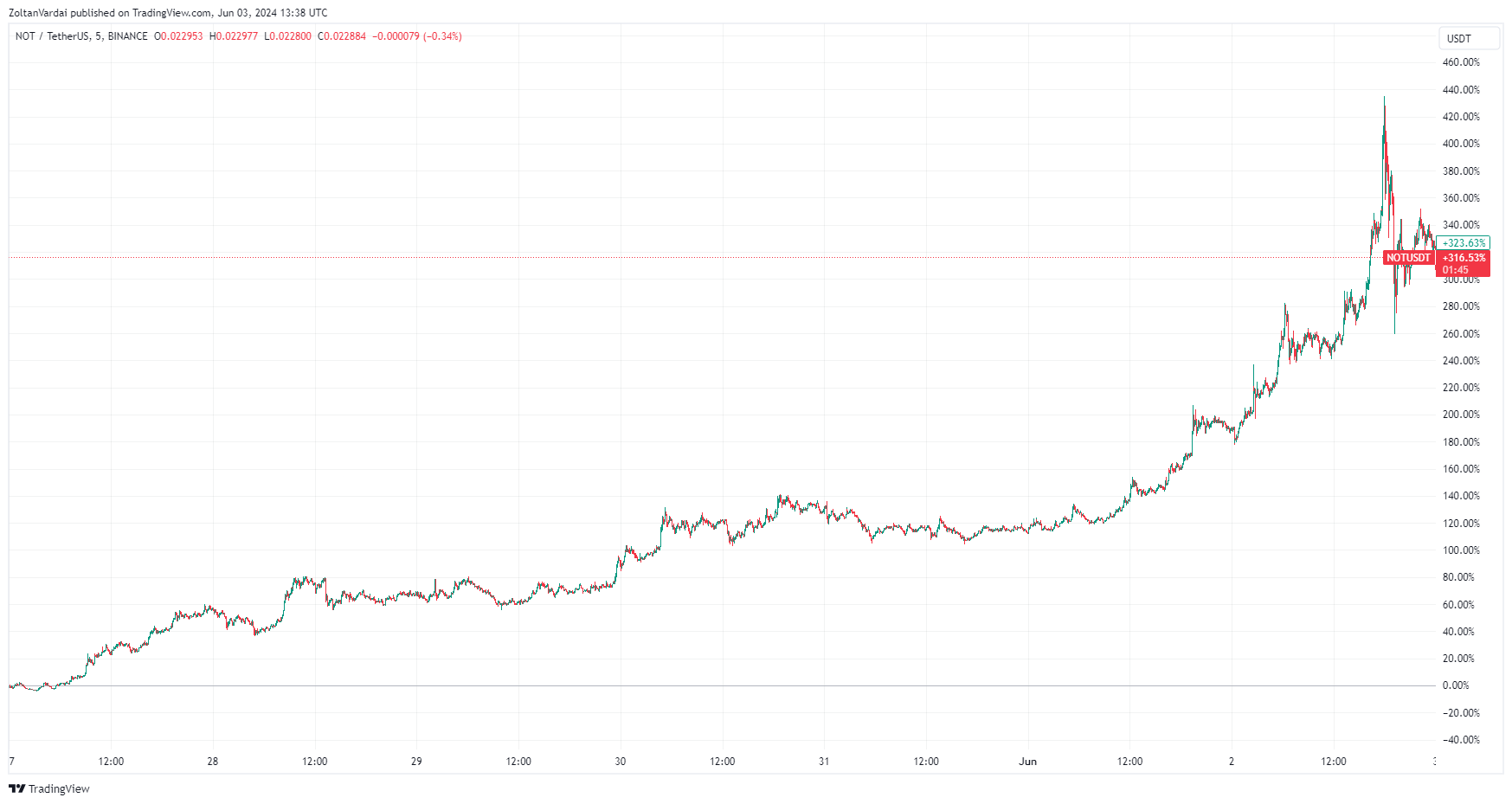

One of the most common forms of Bitcoin price fraud is pump and dump schemes. In this scheme, fraudsters artificially inflate the price of Bitcoin by creating a false demand. They do this by spreading false news or rumors about the cryptocurrency, encouraging others to buy it. Once the price has reached a peak, the fraudsters sell their holdings at a profit, leaving unsuspecting investors with significant losses. This practice is particularly harmful as it can lead to a loss of confidence in the market and discourage potential investors from participating.

Another form of Bitcoin price fraud involves the use of bots to manipulate the market. These bots are computer programs designed to automatically buy and sell Bitcoin at predetermined prices. By flooding the market with buy or sell orders, fraudsters can manipulate the price to their advantage. This practice is known as wash trading, and it can significantly distort the true value of Bitcoin.

Moreover, Bitcoin price fraud can also occur through the manipulation of exchange rates. Some exchanges may collude with fraudsters to artificially inflate or deflate the price of Bitcoin. This can be achieved by manipulating the order book, where buy and sell orders are recorded. By controlling the order book, exchanges can create a false impression of market activity, leading to misinformed trading decisions.

The implications of Bitcoin price fraud are far-reaching. It not only affects individual investors but also undermines the credibility of the entire cryptocurrency market. When investors lose faith in the market due to fraudulent activities, it can lead to a decrease in liquidity and a decline in the overall value of Bitcoin. This, in turn, can have a negative impact on the broader adoption of cryptocurrencies as a legitimate financial asset.

To combat Bitcoin price fraud, several measures can be implemented. Firstly, regulatory bodies should establish strict regulations and oversight to monitor cryptocurrency exchanges and prevent fraudulent activities. This includes implementing Know Your Customer (KYC) policies to ensure that exchanges verify the identities of their users.

Secondly, exchanges should invest in advanced security measures to protect against bot attacks and wash trading. This can involve implementing sophisticated algorithms to detect and prevent suspicious trading patterns. Additionally, exchanges should promote transparency by providing real-time data and order books to enable users to make informed trading decisions.

Furthermore, investors should exercise caution when investing in Bitcoin and other cryptocurrencies. It is crucial to conduct thorough research and due diligence before investing, as well as to be aware of the risks associated with the market. By staying informed and vigilant, investors can minimize their exposure to Bitcoin price fraud.

In conclusion, Bitcoin price fraud is a significant concern within the cryptocurrency market. It poses a threat to individual investors and the credibility of the market as a whole. By implementing strict regulations, promoting transparency, and fostering a culture of vigilance, we can work towards a more secure and trustworthy Bitcoin market.

This article address:https://www.binhlongphanthiet.com/eth/69c61999311.html

Like!(929)

Related Posts

- Ripple Bitcoin Share Price: A Comprehensive Analysis

- Title: Navigating the Process of Withdraw from Binance: A Comprehensive Guide

- Why Is the Price of Bitcoin Dropping?

- **Withdrawal Bitcoin from Cash App: A Comprehensive Guide

- Iran Mosque Bitcoin Mining: A Controversial Trend

- **Withdrawal for This Coin Is Currently Turned Off: Binance's Temporary Measure

- Bitcoin Mining: GPU vs. CPU – Can You Do Both at the Same Time?

- Five Bitcoin Price Charts Analyzing the Dramatic Q1 2022 Conclusion

- Title: Unveiling the Power of the Claim Bitcoin Wallet APK: A Comprehensive Guide

- Software Mining Bitcoin Terbaik: Enhancing Your Cryptocurrency Mining Experience

Popular

Recent

The Richest Bitcoin Wallets: A Closer Look at the Wealthiest Bitcoin Holders

The Antminer S9: A Game-Changer in Bitcoin Mining

Title: Navigating the Process of Withdraw from Binance: A Comprehensive Guide

Use Real Email for Bitcoin Wallet: Why It Matters

How to Use Binance to Trade: A Comprehensive Guide

The Rise of ELFBTC Binance: A Game-Changer in the Cryptocurrency World

How to Get Coins from Binance to Binance US: A Step-by-Step Guide

Electrum Bitcoin Cash How: A Comprehensive Guide to Using Electrum for BCH

links

- Bitcoin Price on July 17, 2017: A Milestone in Cryptocurrency History

- **Steam Game Mining Bitcoin: A New Frontier in Gaming and Cryptocurrency

- Bitcoin and Altcoin Wallet Bit: A Comprehensive Guide

- Bitcoin Price in April 2019: A Look Back at a Volatile Month

- Transfer Funds from Bitcoin Wallet to Bank: A Step-by-Step Guide

- How to Get a Paper Wallet for Bitcoin: A Comprehensive Guide

- The Bitcoin Mining Council: A Game-Changer in the Cryptocurrency Industry

- Bitcoin Cash Cryptocompare Profitability: A Closer Look

- **Reddit Bitcoin Mining Android: A Comprehensive Guide to Mining Crypto on the Go

- When Was Bitcoin Cash Announced: The Birth of a New Cryptocurrency